The World Milk Crisis 2020 - what are the scenarios for future events?

Volodymyr Andriets

analyst

Association of Milk Producers

During the global quarantine analytical platform IFCN conducts weekly international webinars for the rapid exchange of information on the state of the world dairy market. Ukrainian producers of raw milk on the IFCN platform are represented by the Association of Milk Producers.

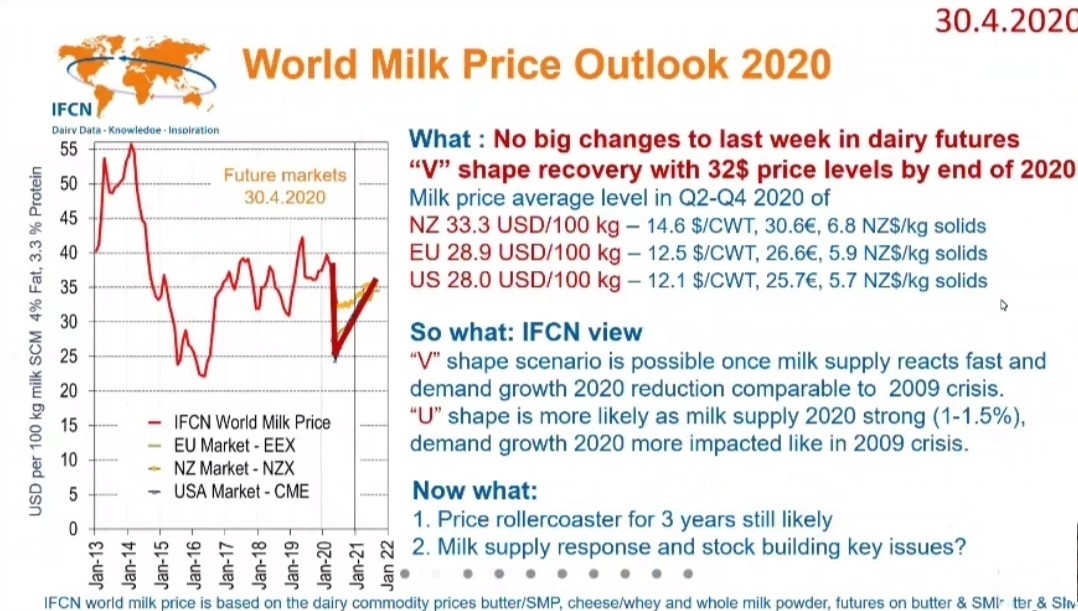

According to the results of IFCN analysis and forecasting, there are two possible scenarios of the recovery from the current crisis in the global dairy industry, based on a general graph of average prices for dairy commodity products: V-shaped and U-shaped scenarios (Fig. 1). The crisis of 2009 was taken as a zero point.

Figure 1. Two scenarios for overcoming the milk crisis

The V-shaped scenario assumes that the supply of raw milk will respond quickly to declining demand, while the reduction in demand will be comparable to the period of 2009.

The U-shaped scenario - by the way, is more likely, - assumes that milk supply will be stronger (+ 1-1.5%) and similar to the current one, but demand growth will be higher than in 2009.

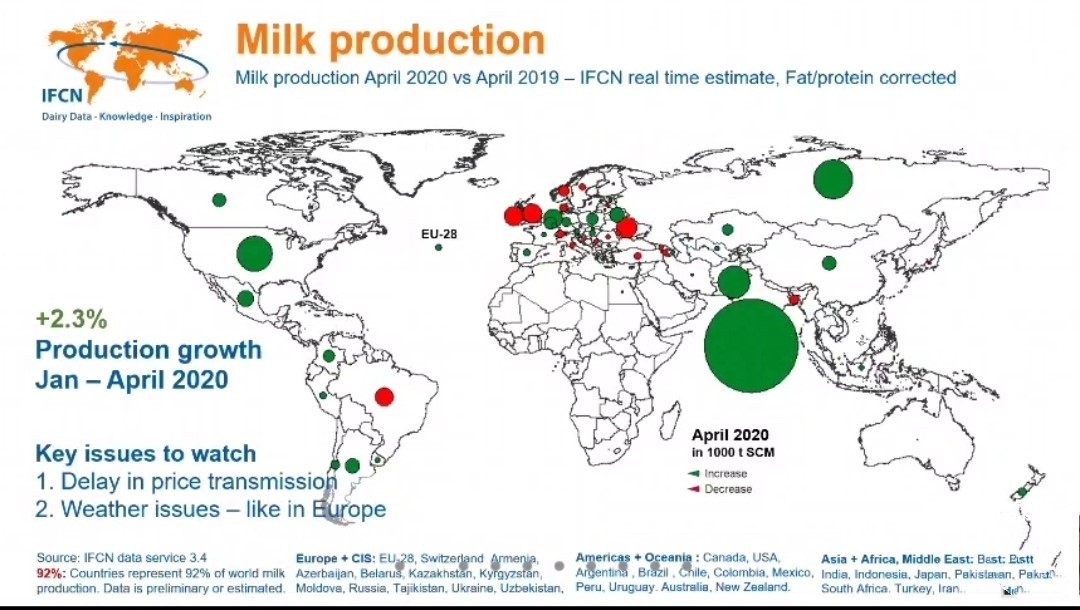

To confirm the realism of the second scenario, experts provide updated info on the situation with milk production in the world, which in the period from January to April increased by 2.3% compared to last year (Fig. 2).

Figure 2. World milk production: April 2019 vs 2020

According to updated information, IFCN keeps its forecasts for the world price of milk at the end of this year at 32 dollars/100 kg.

It is expected that in the 2nd-4th quarters the average price for milk in the EU will be 28.9 dollars/100 kg, in the USA ―28.0 dollars/100 kg, and in New Zealand - 33.3 dollars/100 kg.

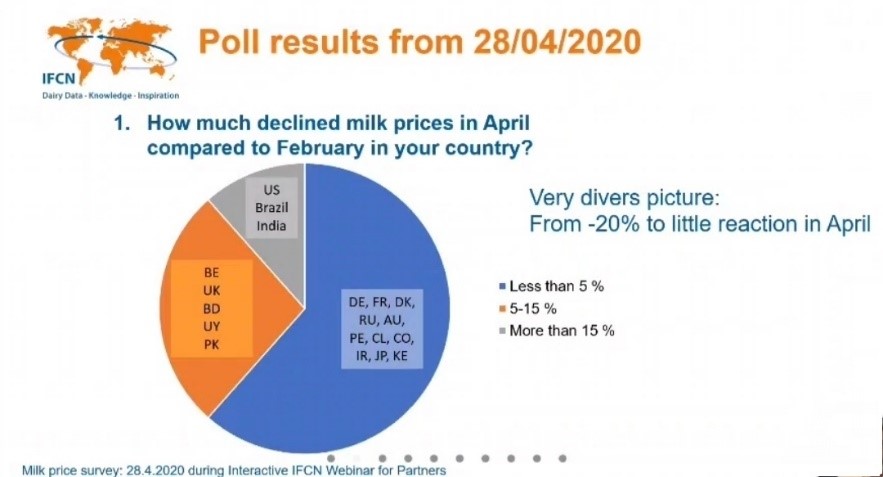

According to the results of an express survey of webinar participants on the fall in the price of raw milk in April compared to February, it was found out that in most countries, including EU members, the fall did not exceed 5%. The same situation is in Ukraine. (Fig. 3). Although the US, Brazil and India reported price reductions of more than 15%.

Figure 3. Results of an online survey among the countries participating in the webinar on the difference in the price of raw milk in April compared to February 2020.

Also attention was paid to two largest importers of dairy products - China and Russia. China, in the first quarter, increased imports of dairy products by 3.4% in terms of milk equivalent compared to last year. Imports of butter increased the most - above 100% and cheese - over 25%, which blocked the decrease in SMP imports by 16%. Of course, this is a positive signal for the markets.

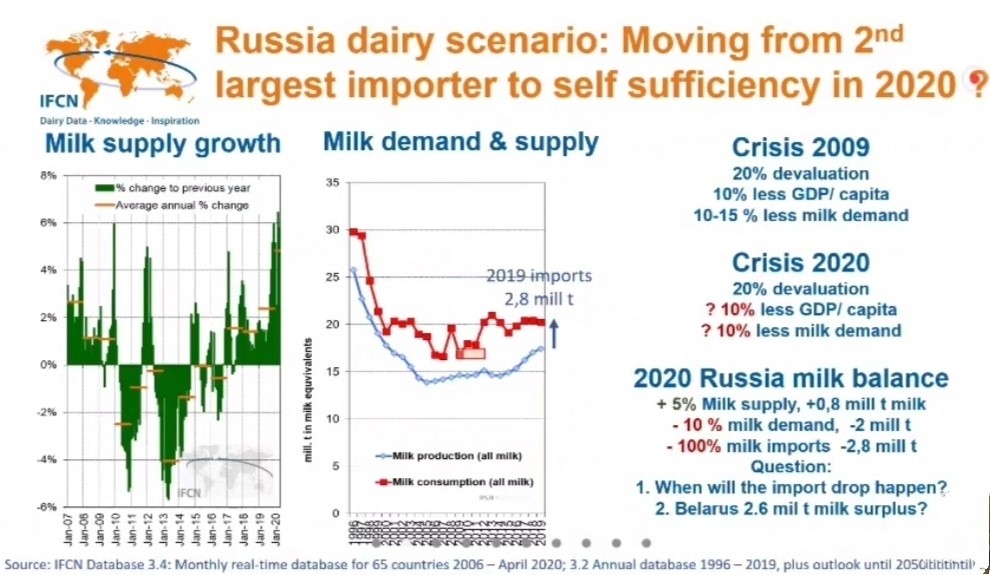

However, on the other hand, Russia, reducing consumption against the background of increasing milk production, is changing its balance and approaching self-sufficiency in dairy products (Fig. 4). This is already affecting its imports and will have consequences in the future.

Figure 4. Dairy scenario of Russia: from the 2nd largest importer of dairy products to full self-sufficiency in 2020.

Summarizing these data through the prism of Ukraine, it is obvious that we should be primarily concerned with the release of the Russian share of Belarusian exports, which may "come" to Ukraine. Moreover, all the conditions for this have already been created, and in the first quarter Belarus has already significantly increased the presence of its products on the Ukrainian market.

AMP Analytical Department based on the results of the IFCN webinar as of May 5, 2020