The increase in the price index following the trading results is a consequence of active demand for New Zealand whole milk powder in foreign markets amid declining milk yields in America and Europe. At the same time, a slight increase in prices for milk fats and a decrease in cheese prices indicate a seasonal decline in activity in the dairy market ahead of the New Year holidays, reports Georgiy Kukhaleyshvili, an analyst at the Association of Milk Producers of Ukraine.

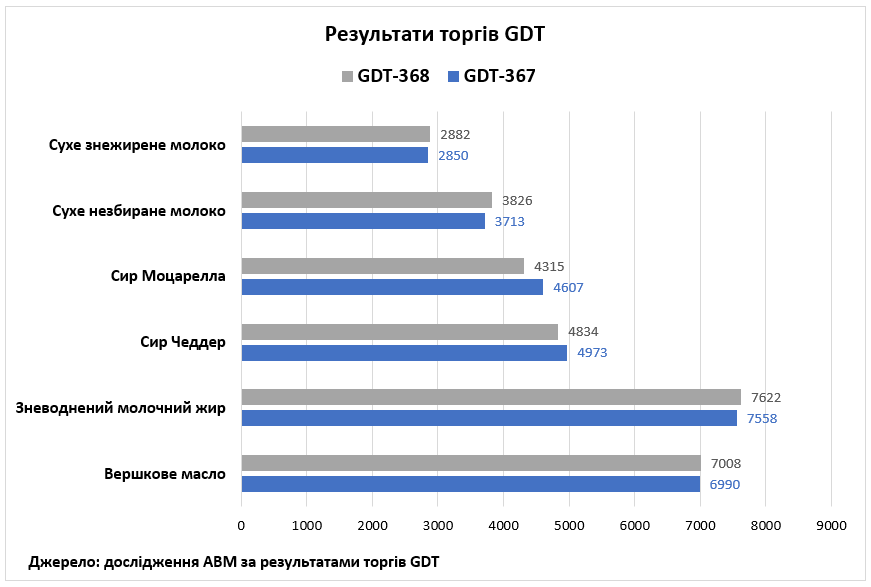

On Tuesday, November 19, the 368th GDT auction took place, resulting in a price index of 1239, up 23 points (+1.9%) since the previous auction on November 5. The average price for dairy products was $4089 per ton, which is $92 more compared to the previous auction results. During the auction, 36,244 tons of exchange-traded goods were sold, which is 351 tons less compared to the last auction. The minimum offer was recorded at 34,576 tons, and the maximum at 41,802 tons. A total of 162 dairy market operators participated in the auction, which is 11 companies fewer compared to November 5.

As a result of the auction, the price of anhydrous milk fat was $7622 per ton (+1%). According to USDA data, minimum prices for milk fat in Western Europe increased, while maximum prices remained unchanged. In the fourth quarter, activity in the dairy market traditionally slows down with the approach of the New Year holidays. Auction organizers predict a 0.1% decrease in the price of anhydrous milk fat in December but expect a 1.5% increase in January 2025.

The price of butter at this auction was $7008 per ton, up 0.5% compared to the previous auction results. According to USDA data, demand for American butter in export markets is quite active. In the US, butter sales volumes are gradually slowing down as most clients have already made their purchases for the New Year holidays, and stockpiles are accumulating in warehouses. In Europe, on the contrary, there is a limited supply of butter, and prices are rising due to a shortage of cream and high raw material prices. Over the past two weeks, there has been active demand for New Zealand butter in foreign markets due to reduced raw milk production in other regions. According to GDT organizers' forecast, the price of butter may decrease by 10.3% in December but increase by 2.9% in February 2025.

The price of whole milk powder was $3826 per ton, up 3.2% compared to the November 5 auction results. According to USDA data, the supply of the product in the US and EU is lower than expected for this period of the year, and production is declining due to limited raw milk supply. Demand for New Zealand whole milk powder is growing in export markets amid declining milk yields in other regions. Buyers in Brazil are interested in importing whole milk powder due to a shortage of raw milk caused by drought and forest fires that have damaged local agriculture. Auction organizers expect the price of whole milk powder to increase by 1.6% in December and by 3.5% in January 2024.

The price of skimmed milk powder increased to $2882 per ton, up 0.9% compared to the November 5 auction results. According to USDA data, there is active demand for New Zealand skimmed milk powder in export markets amid slowing milk yields in other regions. There is a limited supply of skimmed milk powder in America and Europe. In Brazil and Algeria, there has been interest in importing skimmed milk powder from Uruguay and Argentina throughout 2024. Auction organizers expect the price of skimmed milk powder to increase by 0.6% in December and by 0.9% in January 2025.

Cheddar cheese prices fell to $4834 per ton (-3.1%), and mozzarella cheese prices fell to $4315 per ton (-6.6%). Demand for cheese from food industry enterprises in the US and Oceania is slowing down. Some cheese factories plan to undergo maintenance during the Thanksgiving holiday period in the US. According to USDA data, Italian-type cheeses are predominantly in demand in the US, while interest in American cheeses is slowing down. Demand for American and New Zealand cheeses remains active in foreign markets. In Europe, there is demand for cheese from food industry enterprises and retail chains. Auction organizers suggest that cheddar cheese may decrease by 16.1% in December and by 5.2% in January, while mozzarella cheese may decrease by 0.5% in January.

The next GDT auction will take place on December 3.

Press service of the Association of Milk Producers

Follow us on Facebook

Related News

AMP Discusses Support for Ukraine's Agri-Food Sector with the World Bank

AMP Agro-Expedition: Ukrainian Farmers' Visit to the Leading Dairy Expo in the USA